Wallet Transactions, Fee Payments Now Attract Extra Charges on SBI Credit Cards

Last updated on

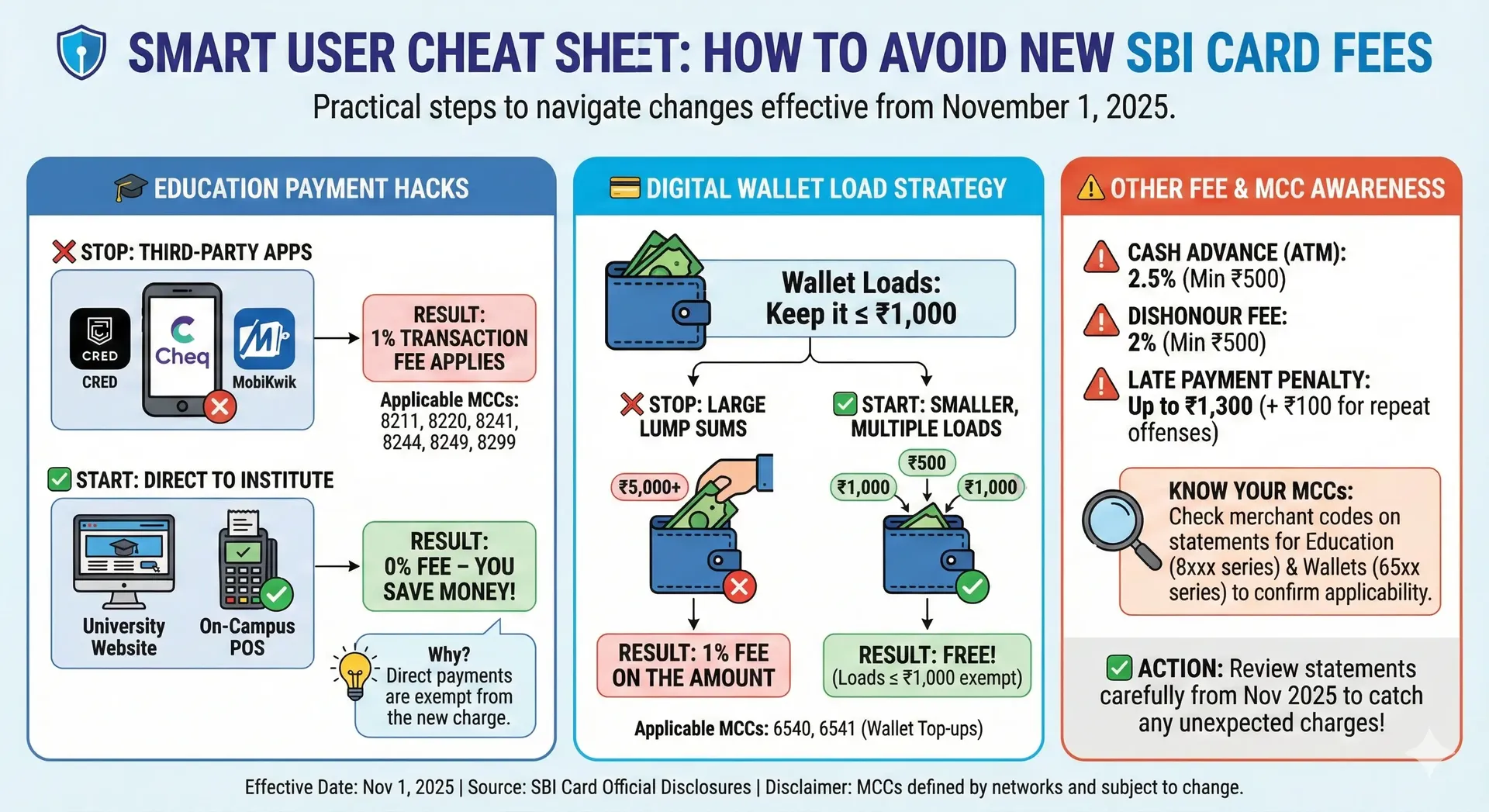

Will the increased fee structure impact you? Yes, if you use apps like CRED to pay the education fee. Check full details inside.

Table of Content

SBI Card recently announced its revised fee structure, introducing new charges for specific education and wallet transactions, as well as updates to several existing fees and penalties. All these changes are now confirmed via SBI Card’s official disclosures.

TL;DR: Effective Changes (Effective from November 1, 2025)

- 1% fee on education payments via third-party apps or aggregators (e.g. CRED, Cheq, MobiKwik).

- No fee for education payments made directly via institution websites or on-site POS machines.

- 1% fee for wallet loads exceeding ₹1,000 under certain merchant codes.

What’s Changing?

Transaction Type | New Charge | Exception / Notes |

|---|---|---|

Education payments via third-party apps (e.g. CRED, Cheq, MobiKwik) | 1% of transaction amount | No fee if paid directly to school, college or university via their website or POS terminals. (Business Standard) |

Wallet top-ups/wallet load transactions above ₹1,000 | 1% of the amount loaded | Applies only to loads exceeding ₹1,000 and under specific merchant category codes. Loads ≤ ₹1,000 remain exempt. (The Economic Times) |

Other Important Fee Updates

Type of Fee | Amount / Rate | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Cash payments at SBI counters (per transaction) | ₹250 (The Economic Times) | ||||||||||||

Cheque payments | ₹200 (The Economic Times) | ||||||||||||

Dishonour fee | 2% of payment amount; minimum ₹500 (The Economic Times) | ||||||||||||

Cash advance fee (domestic/international ATMs) | 2.5% of transaction amount; minimum ₹500 (The Economic Times) | ||||||||||||

Card replacement fee | ₹100-₹250 depending on the card; Aurum cards replaced at ₹1,500. (The Economic Times) | ||||||||||||

Late payment charges (MAD = Minimum Amount Due) |

+ Additional ₹100 if MAD is not cleared for two consecutive billing cycles. (The Economic Times) |

SBI Card Fee Change: Applicable Merchant Codes & Identification Details

The new education-payment fee will apply only when payments are made through third-party merchants identified under the following Merchant Category Codes (MCCs): 8211, 8220, 8241, 8244, 8249, and 8299.

SBI Card’s notice clarifies that wallet load fees apply under merchant codes 6540 and 6541, though these codes are defined by card networks and may change.

Timeline and Official Notice by SBI Card

SBI Card first published these changes on its customer notices page on September 29, 2025. All new fees and revised charges became effective from November 1, 2025. (The Economic Times)

SBI Card Revised Charges: Meaning For You

If you are an SBI Cardholder who uses digital wallets frequently or pays education fees via apps, you will now need to factor in an additional cost.

These changes signal a shift in how credit card issuers are managing costs associated with digital payments and third-party aggregators.

Users who rely heavily on app-based payments for school fees or frequent wallet top-ups will see higher costs. Direct payments to institutions via institutional websites or campus POS machines will become more cost-effective for education fees.

Do This If You’re an SBI Card User

- When paying tuition or school fees, use your institution’s website or POS terminal to avoid the 1% third-party app fee.

- Keep wallet loads at ₹1,000 or less wherever possible to avoid wallet load fees.

- Check your credit card statements closely from November 2025 onwards for unanticipated charges.

- Understand which cards of yours fall under these MCCs if you use multiple credit cards. These fees apply only to SBI Cards under the designated merchant codes.

Also Read: Merchant Category Codes in India

While at face value these changes may seem minor, 1% for many, the cost could add up over multiple transactions.

We’ve also seen similar adjustments across other banks, including Kotak Mahindra Bank, which altered utility, education payment, and wallet load fees earlier in 2025. (The Economic Times)

About the Author

Anmol

Anmol writes detailed blogs and content about credit cards available in India and how to take full advantage of credit cards while avoiding marketing noise.