Top Credit Card Issuers in India

Check the top issuers of credit cards in India, including top banks like HDFC and ICICI, public sector players, and international issuers.

Table of Content

India's credit card market has grown to over 111.19 million cards in circulation as of June 2025, marking a robust 7.64% year-over-year growth.

The monthly expenditures hit ₹1.89 trillion in May 2025, a 14.5% YoY increase, and over 760,000 net new cards were issued in the month.

Total Number of Credit Cards Issued in India (As of June 2025)

- Total Market: 111.19 million cards with 7.64% YoY growth

- Spending: ₹1.89 trillion in May 2025, 14.5% YoY growth

- New Issuances: 760,000 net additions in May 2025

How Many Cards Do Private Sector Banks Issue in India?

Private sector banks dominate India’s credit card market, with HDFC, ICICI, and Axis Bank collectively issuing tens of millions of bank credit cards while driving innovation and market growth.

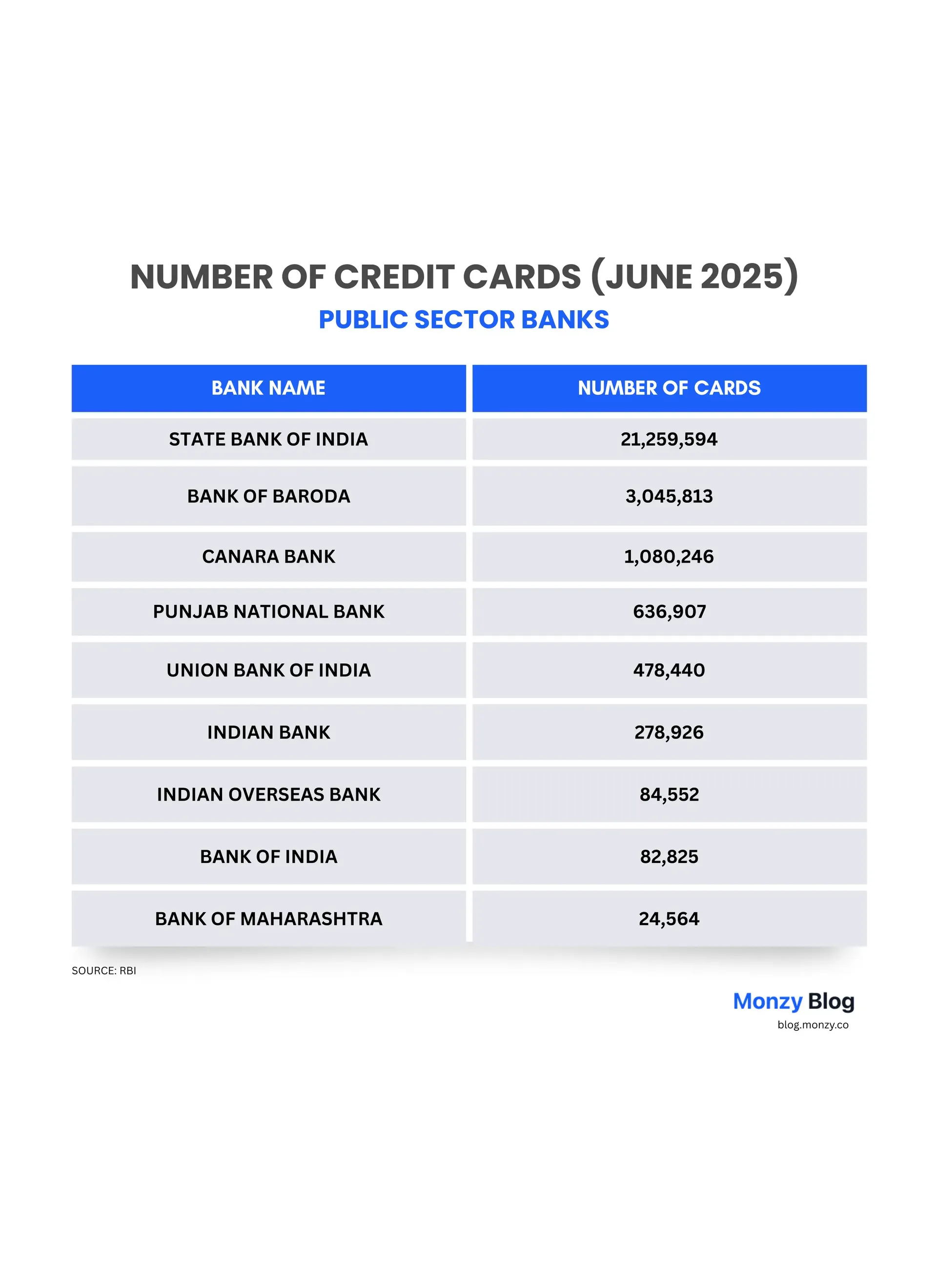

How Many cards Do Public Sector Banks Issue in India?

Public sector banks remain foundational to the bank credit card landscape in India, with State Bank of India and Bank of Baroda leading the pack and serving millions of cardholders nationwide.

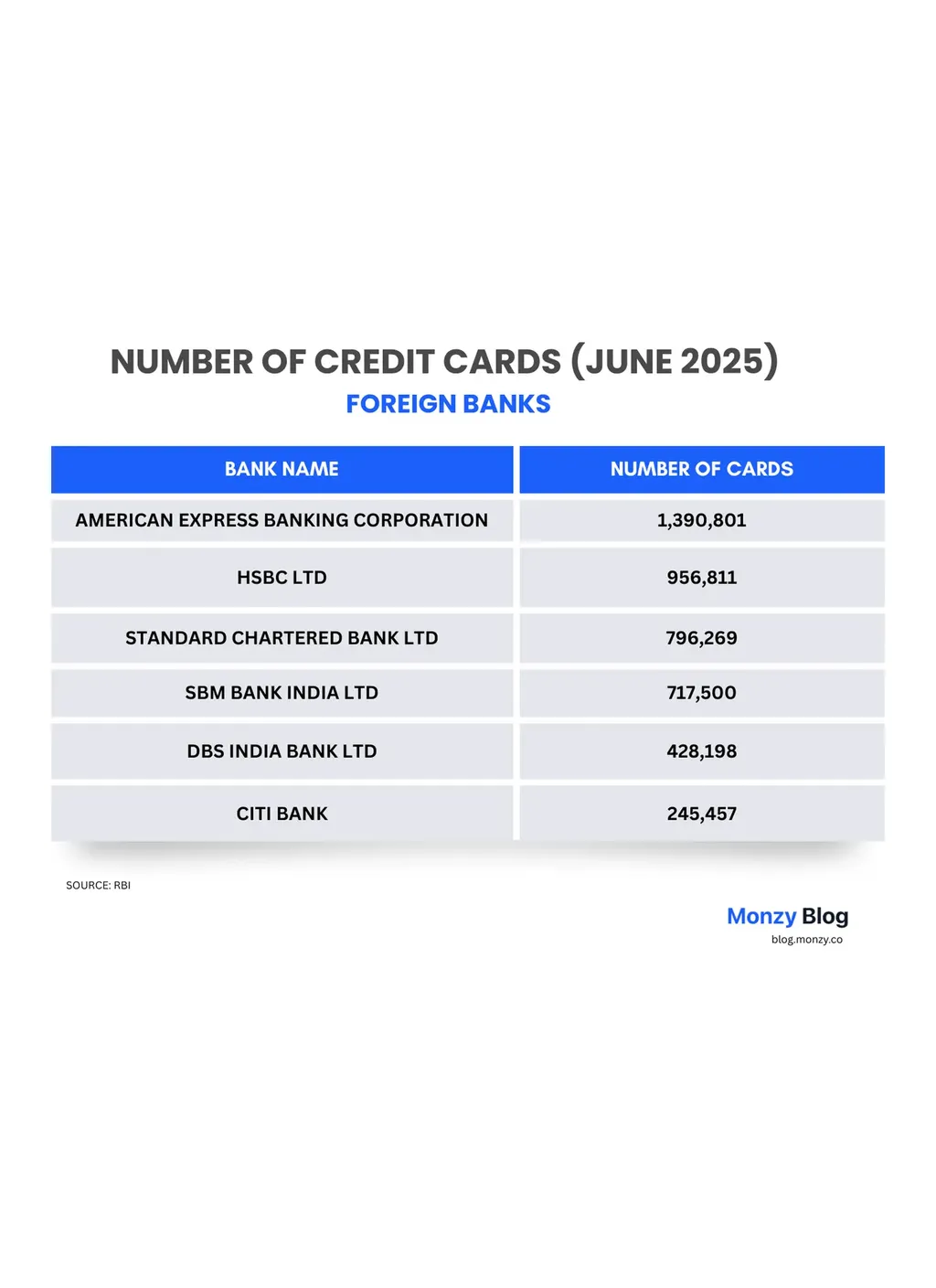

How Many Cards Do Foreign Banks Issue in India?

Foreign banks, such as American Express and HSBC, play a niche yet influential role, offering over 1 million cards through premium and globally recognized services.

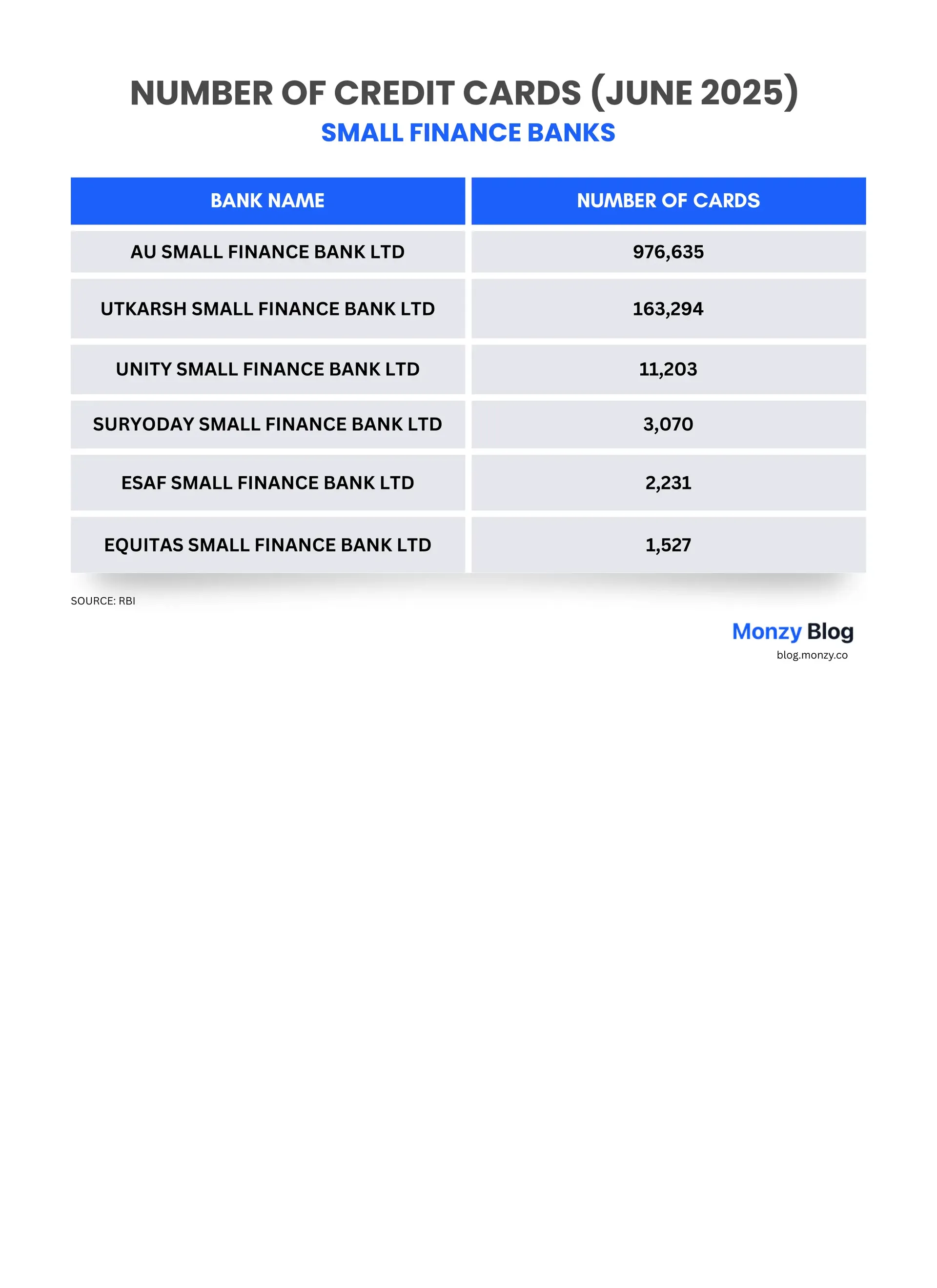

How Many Cards Do Small Finance Banks Issue in India?

Small finance banks are recent entrants, steadily growing their footprint with nearly a million cards in circulation, spearheaded by AU Small Finance Bank.

All Major Credit Card Issuers in India

Looking at the most recent circulation numbers in India, we can confidently say that private banks dominate the market with a 71% market share. Out of this, the top 8 issuers dominate the industry with an 89% market share.

Let’s look at these players first:

HDFC Bank — Market Leader with 22% Market Share

- Market Position: Largest credit card issuer in India.

- Active Cards: 24.48 million cards (22% market share).

- Monthly Spends: ₹51,158 crore (27.9% spend share).

- Growth: 25% YoY growth in spends.

- Key Products: Infinia, Regalia, Tata Neu series.

- Competitive Edge: Strong premium card portfolio, great partnerships, and strong customer acquisition capabilities.

HDFC Bank is the largest private sector bank and the top credit card issuer in India with over 24 million active cards. The bank has shown rapid growth, with monthly spends exceeding ₹51,000 crore, emphasizing customer-centric features.

Established in 1994, HDFC Bank has been important in increasing card penetration rate through its growth initiatives and a strong card portfolio. It offers credit cards ranging from everyday cashback cards to premium lifestyle offerings, catering to urban professionals.

SBI Cards — Pure-play Giant with 19% Market Share

- Market Position: Second-largest issuer of credit cards in India.

- Active Cards: 21.19 million cards (19.1% market share).

- Monthly Spends: ₹30,572 crore (16.6% spend share).

- Growth: 22.8% YoY spend growth.

- Strategic Advantage: Relationship with SBI Bank, increasing the trust factor and reach to Tier-II cities and beyond.

SBI Cards, a subsidiary of State Bank of India, operates as India's only listed pure-play credit card company. It is the second-largest issuer with 21 million cards and 19% market share.

The company provides diverse options like the SimplyCLICK for online shopping and ELITE for premium rewards. With ₹30,000 crore monthly spends and 23% growth, it excels in rural outreach offerings, thanks to SBI’s vast banking network.

ICICI Bank — Digital Innovation Leader

- Market Position: Third-largest issuer.

- Active Cards: 17.98 million cards (16% market share).

- Monthly Spends: ₹33,351 crore (18.2% spend share).

- Growth: 8% YoY growth (modest compared to peers).

- Strategy Focus: Aggressive co-branded card strategy and digital-first approach.

- Recent Challenges: Net card additions dropped by 287,439 in June 2025.

ICICI Bank has a 16% market share in India with approx. 18 million cards in circulation. It has adopted an interesting strategy of specializing in co-branded products like the Amazon Pay card.

With monthly spends around ₹33,000 crore, ICICI is a strong player in the market with focus on contactless payments and personalized offers.

Axis Bank — Going Strong Post Citibank Acquisition

- Market Position: Fourth-largest issuer.

- Active Cards: 15.05 million cards (14% market share).

- Monthly Spends: ₹21,868 crore (11.9% spend share).

- Growth: 16.79% YoY growth.

- Strategic Milestone: Completed Citibank India acquisition in 2023 strengthening urban customer base.

- Key Products: Magnus, Select, Flipkart co-branded cards.

- Recent Changes: Significant devaluations in June 2025 affecting Magnus and Flipkart cards.

Axis Bank ranks as the fourth-largest issuer with over 15 million cards, boosted by its 2023 acquisition of Citibank's portfolio, giving it a 14% market share.

The bank's strategic acquisition of Citi's customer base has enhanced its competitive position in the premium credit card segment. Known for its premium card offerings, particularly the Magnus series, Axis credit cards gained immense popularity among high-spending customers before recent devaluations.

Kotak Mahindra Bank — Powerful Player in Recovery Phase

- Market Position: Fifth-largest issuer of credit cards in India.

- Active Cards: 4.8 million cards (4% market share).

- Growth:17% decline in growth due to previous RBI restrictions and ban.

- Recovery Status: RBI ban lifted in February 2025, allowing them to onboard new customers.

- Strategic Focus: Premium segment and fintech partnerships.

Kotak Mahindra Bank serves around 5 million cardholders, holding a 4% market share, and is known for its recent portfolio revamps following RBI restrictions.

It caters to affluent customers with high rewards on dining and travel, integrating fintech features for seamless experiences. Despite past challenges, it’s recovering fast by focusing on customizable benefits and digital-first services. It primarily targets affluent urban customers who value exclusive lifestyle benefits and personalized services.

Yes Bank — Recovering from Challenges

- Active Cards: 2.43 million cards.

- Recent Performance: 25% credit card growth.

- Focus Areas: Secured lending transition and credit quality improvement.

Yes Bank, with about 2.4 million cards and a 2% market share, has undergone transformation to focus on digital and secured lending.

Recovering from earlier setbacks, it shows 15% growth, emphasizing asset quality and fintech integrations. Yes Bank has undergone a significant transformation following its restructuring and is now focused on rebuilding its credit card portfolio with renewed emphasis on digital innovation.

IDFC FIRST Bank — Innovation-focused Card Issuer

- Active Cards: 3.55 million cards.

- Key Innovation: Lifetime free cards with low interest rates.

- Strategy: Customer-first philosophy with digital-native approach.

IDFC FIRST Bank has rapidly grown to 3.5 million cards, offering lifetime-free options with low interest rates starting at 8.5%. Targeting young professionals, it features cards like Millennia for cashback and IndiGo co-branded for travel. It’s recent partnership with IndiGo for co-branded cards demonstrates its commitment to providing value-driven products.

With 20% YoY growth and a strong market share, it prioritizes customer-first innovations like UPI-linked cards.

Bank of Baroda — Leading Public Sector Card Issuer

- Active Cards: Over 3.04 million cards.

- Growth: 17% YoY growth.

- Strategic Focus: Co-branded partnerships and digital expansion.

Bank of Baroda has over 3 million cards in circulation through its BOBCARD arm, with a 3% market share and strong public sector presence.

It offers co-branded cards with IRCTC for travel and products like Eterna for rewards. As part of the larger Bank of Baroda ecosystem, BOBCARD uses the extensive branch network and government relationships to serve both urban and rural customers across India.

RBL Bank — Specialized Card Issuer

- Active Cards: 3.9 million cards.

- Growth: -3% decline.

- Challenges: High asset quality stress in credit cards and microfinance space.

- Specialization: Dining and travel focus.

RBL Bank has about 3.9 million active cards in circulation and is known for dining and travel rewards categories. Holding a 3.5% market share, it offers high rewards rates, though faces challenges related to asset quality.

Despite these headwinds, RBL Bank continues to use its expertise in credit card processing and its partnerships with fintech companies to maintain its position as a focused player in the Indian credit card industry.

International Issuers & Foreign Banks

Apart from local players, there are three major international banks with an enviable portfolio of products for rich and affluent members of the society. Together, they represent a minority share in the market, but have high aspirational value among credit card users in India.

American Express — Premium Segment Leader

- Active Cards: 1.46 million cards in India.

- Global Context: 25.1% of global premium credit card market.

- Growth: 15% YoY growth, added 107,086 cards in FY25, till date.

- Focus: High-net-worth individuals and premium spending categories.

- Competitive Advantage: Superior customer satisfaction and exclusive benefits.

American Express, with 1.46 million active cards in India holds a 1.3% market share. It targets high-net-worth individuals and affluent customers through its portfolio of premium cards.

Though it has a small market share in India, American Express commands significant influence in the premium segment with higher average spending per card and strong brand loyalty.

HSBC Bank — Private Banking Focused Issuer

- Active Cards: 0.88 million cards

- Growth: 25% YoY growth, added 216,997 cards in FY25

- Recent Launch: HSBC Privé for ultra-high-net-worth individuals

- Target Segment: UHNWI and HNWI

HSBC Bank caters exclusively on the ultra-premium segment in India with its focus on international perks and wealth management integration. HSBC's credit cards are designed for international travelers and global professionals who require premium banking services across multiple countries

The bank's recent launch of HSBC Privé for customers with investable assets above $2 million demonstrates its commitment to serving India's wealthiest individuals with world-class private banking services.

Standard Chartered Bank — Established International Player

- Active Cards: 0.86 million cards

- Key Products: Ultimate, Platinum Rewards, EaseMyTrip co-branded

- Focus: Premium banking

Standard Chartered Bank has built a strong presence in the premium banking sector over several decades of operations in the country.

The bank offers credit card products like the Ultimate and Platinum Rewards series, targeting affluent customers who value international banking relationships and premium services. Standard Chartered's strength lies in its global network, trade finance expertise, and focus on comprehensive international banking solutions.

Small Finance Banks & Regional Players

Apart from the big ones, there are many regional players like Federal Bank, AU Small Finance Bank, etc., offering credit card products in the country.

AU Small Finance Bank — Customization Expert

- Active Cards: Over 1 million cards.

- Key Products: LIT (customizable), Altura, Zenith series, ixigo co-branded

- Unique Proposition: SwipeUp platform for card upgrades and customizable benefits

AU Small Finance Bank, with over 1 million active cards, represents the new generation of digital-first financial institutions that are disrupting traditional banking models.

Originally an automobile financier from Jaipur, AU Bank has transformed into a comprehensive small finance bank with innovative credit card offerings including the unique SwipeUp platform that allows customers to upgrade their cards and customize benefits. The bank's LIT card series and partnerships with travel platforms like ixigo demonstrate its focus on younger, tech-savvy customers who value flexibility and digital convenience.

Frequently Asked Questions

What is the current size of India's credit card market?

India's credit card market has over 111.19 million cards in circulation as of June 2025, with a 7.64% year-over-year growth, driven by digital adoption and rising consumer spending that reached ₹1.89 trillion in May 2025, a 14.5% YoY increase.

Who are the top credit card issuers in India?

The market is highly concentrated, with the top 4 issuers (HDFC Bank, SBI, ICICI Bank, and Axis Bank) controlling 71.1% of the share, and the top 8 commanding nearly 90%; this blog covers over 20 key issuers, including these leaders and others like American Express and HSBC.

What factors should I consider when choosing a credit card issuer?

While it can be a personal choice, you should pick an issuer based on your spending habits and the offered perks. You should also consider the issuer's market position, reward programs, fees, lounge access, and co-branded partnerships, among other factors. For example, travelers might prefer issuers like Axis Bank for airport perks, while shoppers could benefit from HDFC's retail tie-ups.

Which issuer has the largest market share?

HDFC Bank leads with the largest share, followed closely by SBI, ICICI Bank, and Axis Bank; together, these top players dominate due to their extensive networks, innovative products, and strong digital integration.

Can I switch credit card issuers easily?

Switching involves applying for a new card and potentially closing the old one, but it may impact your credit score; it's often easier to compare options through platforms like Monzy, which analyzes issuers and recommends the best credit card based on your needs without immediate commitment.

What data sources were used for the information on this page?

The content draws from RBI’s monthly reports and reliable sources like Business Standard and The Economic Times.

About the Author

Anmol

Anmol writes super targeted posts about availing credit card offers and getting maximum benefits.